Business

Single Vs Regular Premium: Which ULIP Should you Buy?

Most of the financial instruments that are used for investing money in the market get the money for these investments from the premium paid for them. Premium is basically the amount that you pay in order to enjoy the benefits of a product. So, instruments that allow investment use the premium for investing in funds. This applies to a ULIP policy as well. The premium paid for the policy is used for investment and insurance cover. Read on to know more about the different types of payment methods.

What is a ULIP policy?

A unit linked insurance plan is a life insurance policy that has the dual benefit of investment and insurance under a single policy. The premium that the investor pays towards the policy is divided into two parts. One part is used for the provision of life insurance cover. The other part is used for investing in market-linked funds. You have the option of investing in equity funds, which carry a high-risk factor and give higher returns to the investor. Or you can invest in debt funds, which carry a low-risk factor and provide low-to-medium returns to the investor. The fund that you select should match your risk appetite and your life goal.

What are the types of premium payments?

When you invest in a ULIP policy, you will come across two ways of paying your ULIP premiums:

- Regular premium

A regular premium is where the policyholder has the option of paying the premium periodically. This can be done on a monthly, quarterly, or yearly basis. Based on your financial capability, you can opt for either of the payment methods that suit you the most. Do keep in mind that you need to be aware of the final date of premium payment. Usually, the premium amount is deducted automatically from your account on the due date.

- Single premium

A single premium is where the policyholder makes a one-time premium payment. Essentially it means that a lump sum amount is paid for premium. This option is suitable for those who can allocate the money required for the premium without the prospect of any financial turmoil. In this, there is no need to keep a track of due dates or worry about fees related to the late payment of premium.

Why is the premium important?

In ULIPs, to be able to enjoy the returns of your investments and to get life insurance cover, you require money. This money comes from premium payments. Not being able to pay for the policy will have severe ramifications on your policy. Firstly, you could end up losing the life insurance cover that is provided under the policy. This could leave your loved ones vulnerable from the expenses related to life risks.

Secondly, your wealth will not grow as there will be fresh investments made in the funds. The returns that you have gained on your investments will be the benefit you can enjoy. If you do not pay the premium, your insurer will give you a grace period. If you fail to pay premium during this grace period, the insurer will start charging you discountenance fees. These fees will be deducted from your fund value. Upon the completion of the lock-in period of 5 years, your insurer will pay you the accumulated amount after deducting all the necessary charges from the fund value.

Which premium option should you go for?

Whether to go for a regular premium or single premium depends on one factor: your wealth. If you are earning substantially enough to not get impacted by a single payment of a huge amount of money, then you should go for the single payment option. However, if you happen to be the only earner in your family with dependents relying on your income, you should opt for the regular premium payment method. If you cannot pay on a monthly basis, you can save enough for quarterly payment. The payment option should be such that it should not create a financial burden for you.

These are the types of premium payments for ULIPs. Do remember that premium payments for ULIPs are eligible for tax exemption under Section 80C of the Income Tax Act.

Business

Expansion Joint Suppliers in UAE Driving Flexible Infrastructure Growth

Contemporary infrastructure is constructed to move, grow and change. Structural movement is inevitable in high rise towers as well as industrial pipelines. It is in this place that expansion joint suppliers in UAE are very important in the support of the projects which require flexibility, durability, and long term performance.

With the increased pace in construction and industrial growth in the region, expansion joint suppliers in the UAE are increasingly becoming key partners in the construction of the systems in a way that they can maintain the stress, changes in temperature, and vibration without sacrificing safety and efficiency.

Expansion Joint Suppliers in UAE Rise with Mega Projects

The UAE boasts of massive development plans in construction and industry. The need to absorb movement and structural integrity is needed in skyscrapers, power plants, refineries, and large scale piping networks.

Expansion joint suppliers in UAE are providing solutions which are in line with the modern engineering standards to meet this demand. Their product finds application in the HVAC systems, pipelines, bridges as well as industrial installations where flexibility is not a choice but rather a necessity. You can take a look at: flow meter uae

Expansion Joints Boost System Longevity

Expansion joints are created to handle thermal expansion, vibration and physical movement. In their absence, systems experience cracking, leakage and early break down.

Managing Thermal Expansion Effectively

The area experiences temperatures variations. Expansion joints enable pipes and structures to contract and expand in a safe manner, avoiding any accumulation of stress and its harm.

Popular Expansion Joint Types Supplied in UAE

In UAE, expansion joint suppliers provide a great variety of joint that is used depending on various applications and environments.

Rubber Expansion Joints for Versatility

The reason why rubber expansion joints are popular is because they are flexible and absorb vibrations. Mostly used in water systems, HVAC networks and industrial piping..

Metallic Expansion Joints for High Pressure Systems

Where high pressure and harsh temperatures are utilized, metallic expansion joints are used to offer strength and reliability. The applications of these joints are usually in oil, gas, and power generation industries.

Fabric Expansion Joints for Specialized Needs

Fabric expansion joints are intended to be used on low pressure applications, where high movements have to be accommodated. They are commonly applied in ducting and in exhaust systems.

Expansion Joint Suppliers in UAE Trend Toward Custom Solutions

What is required in one project is not necessarily the same as what is required in another project. This has created a move towards an increase in the number of expansion joint suppliers in UAE that do not offer standard products, but rather customized solutions.

Customization means that the expansion joint is suitably matched to the size of the pipe, the amount of movement, the levels of pressure and the environmental factors. This customization is efficient in boosting the efficiency of the system as well as minimizing the problem of maintenance.

Material Quality as a Key Differentiator

The expansion joint suppliers in UAE are interested in materials that can cope with the severe operating conditions.

Most of the high grade rubber, stainless steel and reinforced fabrics are used to maintain durability. Such materials are resistant to corrosion, heat, and chemical which is essential in the industrial setting.

Expansion Joint Suppliers in UAE Supporting Multiple Industries

Expansion joints are not limited to one sector. Their applications span across various sectors that need the movement of fluids and structural integrity.

Construction and Infrastructure Projects

Expansion joints are used in buildings and bridges to permit structural movement which can be as a result of variations in temperature and changes in load. This eliminates cracks and structural damage in the long run.

Oil and Gas Installations

Oil and gas facilities have pipelines that are continuously under pressure and are subject to changes in temperature. Expansion joints are used to ensure effective and safe flow systems.

HVAC and Mechanical Systems

Expansion joints are used to minimise the vibration and noise produced by the HVAC systems whilst maintaining efficiency in the airflow over extensive networks.

Technology and Engineering Trends in Expansion Joints

The way expansion joints are made is being redesigned with innovation. UAE expansion joint suppliers are embracing advanced engineering practices in order to increase performance.

The contemporary designs are aimed towards better flexibility, better pressure tolerance, and better service life. These developments favor increasing sophistication of industrial systems.

Installation Expertise Boosts Performance

The most efficient expansion joint needs to be installed correctly. UAE expansion joint suppliers usually give technical advice to make sure it is correctly aligned and installed.

Installation which is done properly will reduce the stress on the joints and will make the joints operate as expected during their service life.

Maintenance Benefits of High Quality Expansion Joints

Quality expansion joints minimise the frequent repairs. This increases maintenance cost reduction and reduces system outage.

Expansion joint suppliers in UAE focus more on products that remain operational over time even in harsh conditions. This is particularly useful in the case of industries that are around the clock.

Compliance and Safety Standards in the UAE

The UAE Projects need to be compliant to the rigorous safety and quality standards. UAE expansion joint suppliers maintain their products to meet the local and international standards.

Compliance promotes safety of the system and facilitates easy project approvals particularly those of the large scale developments.

Expansion Joint Suppliers in UAE as Long Term Partners

It is not just a matter of making a choice of supplier. Dependable expansion joint suppliers in UAE are long term partners who are aware of what is needed in the project and how to scale with time.

Flexible Infrastructure Built for the Future

Flexibility is one of the design principles as the UAE keeps advancing in construction and industry. Expansion joints facilitate such kind of flexibility by safeguarding systems against the damage of stress and movement.

Having good engineering attention, quality material and industry knowledge, the growth joint suppliers in UAE are critical in creating infrastructure that is resilient, efficient and even future oriented.

Expansion Joints Power Stability Behind the Scenes

Expansion joints are often unknown but they provide stability to some of the most complicated systems. Their influence on the safety, durability and performance renders them essential.

Modern projects have the balance of the strength and flexibility that characterizes the success of an infrastructure based on the trusted expansion joint suppliers in UAE.

Business

Lodha Aurum Elitis Tower, Kanjurmarg East, Mumbai: Opening Time, Location and Connectivity

Lodha Aurum Elitis Tower, located at Kanjurmarg East Mumbai It is one of the high-end residential development developed by the highly regarded Lodha Group. The development is planned to blend comfort, luxury, and convenience, addressing the demands of urban inhabitants.

Lodha Aurum Elitis comprises well-designed 2 and 3 BHK homes that range in size between 1015 and 1431 sq. feet. The development was officially launched in October 2009and possession beginning in May 2013. The development is comprised of two towers and houses the 144 units.

Facilities as well as Amenities:

The community offers a wide range of amenities that aim to improve the quality of life of the residents

-

Exercise and recreation A gym that is well-equipped as well as a swimming pool and areas specifically designed for sporting activities.

-

children’s play Area: Safe and fun play areas for children.

-

sports facilities: Court for tennis, squash court, cricket pitch skate arena, aerobics area tennis court, basketball court and a jogging & cycling track.

-

Golf Course for golfers this project has the golf course as a separate.

-

Power Backup Providing uninterrupted electricity to every unit as well as common areas.

-

RO Water System: Provision of safe and clean drinking water.

-

Security Security services that are available 24/7 with surveillance via CCTV to guarantee the security of residents.

The facilities are designed to offer an overall living experience, accommodating the various demands of the residents.

Locativity and Connection

Strategically situated strategically in Nehru Nagar, Kanjurmarg East This project has an excellent connection:

-

Transportation Close proximity to important highways and public transport facilities makes it easy to travel to various areas of Mumbai.

-

Education Institutions Reputable schools, colleges and universities are situated nearby and are ideal for families with children.

-

Hospitals: Health clinics as well as hospitals within the area offer prompt medical aid.

-

Shop and entertainment: Malls, supermarkets restaurants, as well as entertainment centers are all easily accessible, increasing the ease for residents.

The location is strategically chosen to ensure that residents can access all necessary services in their reach, adding to a relaxing and convenient living.

The pros and cons

Residents’ feedback and the prospective buyers highlights a number of advantages as well as concerns:

Pros:

-

Modern amenities: The wide range of facilities meets a variety demands of life, and encourages healthy and active living.

-

Strategic Localization: Excellent connectivity and close proximity to services essential to life make it an ideal place to reside.

-

Qualitative Construction This project is a reflection of the commitment of the Lodha Group to excellence and quality in construction.

Cons:

-

Pricing Point Pricing that is higher might be an issue for buyers with a tight budget.

-

Occupancy Levels Potential buyers have expressed concerns about the occupancy rate within the complex.

It’s recommended for customers to go on the website and talk to current residents to get an extensive comprehension of the experience.

Summary Table

| Aspect | Details |

|---|---|

| Address | Nehru Nagar, Kanjurmarg East, Central Mumbai Suburbs, Mumbai |

| Configurations | 2 – and 3- BHK homes with sizes ranging between 1015 and 1431 sq.ft. |

| Amenities | Swimming pool, Gymnasium with children’s play areas, the tennis court, the cricket field, skating rink, squash court with aerobics area basketball court cycling track and jogging track the golf course has power backup RO water supply system 24 hours security, CCTV monitoring |

| Possession Date | May 2013 |

| Nearby Facilities | Health facilities, educational institutions and shopping centers, restaurants and entertainment hubs |

| Pros | Modern facilities, strategic location, top-quality construction |

| Cons | Concerns about premium pricing, occupancy levels |

In the end, Lodha Aurum Elitis Tower located in Kanjurmarg East provides a lavish and well-connected lifestyle that is equipped with the latest facilities and amenities. Although the price is high, it reflect the high-end benefits of the location and quality buyers are advised to consider their needs and conduct extensive due diligence prior to making a choice.

Business

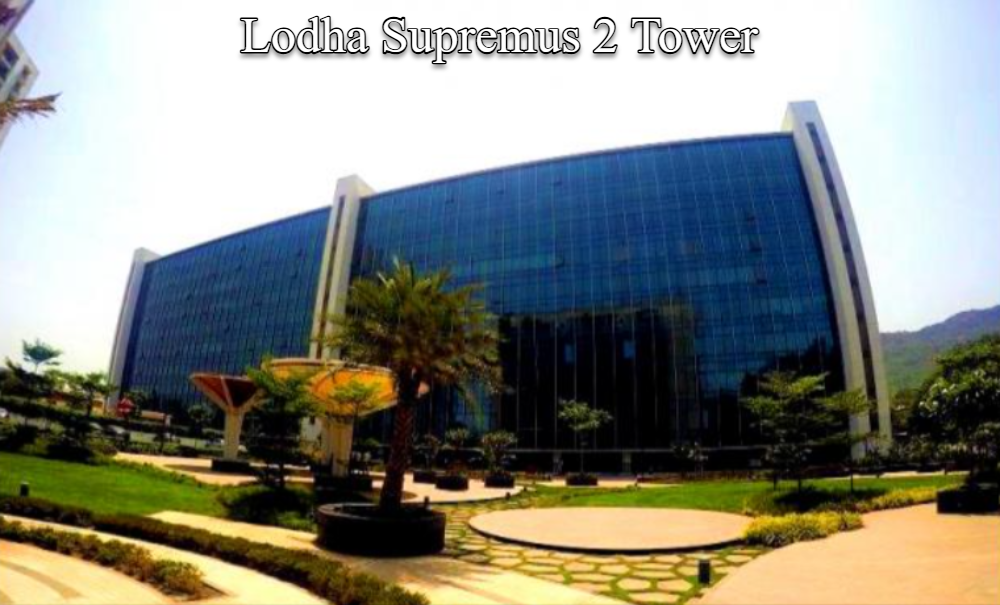

Lodha Supremus 2 Tower, Thane, Maharashtra: Opening Time, Location and Connectivity

Lodha Supremus II, situated inside the Wagle Industrial Estate of Thane, Maharashtra, is a notable commercial development of the Lodha Group. This office building of Grade A is built to meet the requirements of businesses in today’s times with state-of-the-art facilities as well as strategically connected.

Project Overview:

The project was completed in 2015. Lodha Supremus 2 spans approximately 1 acre. It has a total area of approximately 350,000 square feet. It is spread over a basement, a ground floor, and nine more floors. Each floor has a large space of approximately 35,000 square feet. This provides the flexibility needed for businesses of different size.

Amenities and Facilities Amenities:

The building is fitted with modern features to create a pleasant work environment.

-

LeED Gold Certificate: Demonstrating a commitment to sustainability in the environment and efficiency in energy use.

-

24/7 Security via CCTV surveillance: Ensuring a safe and safe environment for all those who use it.

-

BMS: Building Management System (BMS): advanced systems for efficient facility management.

-

High Speed Elevators Facilitating efficient and quick movement in the building.

-

Parking for Visitors: Dedicated spaces to accommodate guests.

-

Power Backup Continuous power source to assure the continuity of business.

-

Emergency Fire Equipment Complete safety precautions in place.

-

Food Court: On-site dining choices for convenience.

All of these features create a contemporary and efficient workplace, which is aligned with the demands of modern business owners.

Lodha Supremus 2 Tower Address:

Wagle Industrial Estate, Thane West, Thane, Maharashtra 400604

Place and Connectivity

Strategically located strategically located on Road Number 22 in Wagle Industrial Estate, Thane West The building provides an excellent connection:

-

Transport Hubs are close by: Approximately 15 minutes from Mulund railway station, and only 50 meters away distance from Tata Motors bus stop, which makes it convenient for commuters to travel.

-

Access to major Highways: Close to both the Eastern Express Highway and Ghodbunder Road offering seamless connectivity to different regions of Mumbai and surrounding regions.

-

Nearby Amenities The surrounding area includes numerous eateries, shopping centers hotels, restaurants, and IT companies, increasing the ease of life for both businesses and their employees.

Operating Hours:

While the specific operating hours are for Lodha Supremus 2 aren’t specifically stated commercial office buildings are typically operating from early morning to late into the evening. Visitors and tenants should confirm the exact times with the individual business or with the building’s management.

Review: Pros and Cons as reported in Reviews:

Feedback from visitors and residents gives insight into the strengths and weaknesses

Pros:

-

Contemporary Infrastructure The tenants appreciate the modern designs and the latest equipment that can meet the requirements of modern-day businesses.

-

Strategic location: The prime location in the Wagle Industrial Estate offers excellent connectivity as well as access to skilled workers.

-

Complete Amenities Facilities like ample parking spaces and a modern infrastructure can enhance the overall experiences for the employees.

Cons:

-

Occupancy Levels There are some reviews that indicate that certain areas within the complex are occupied at lower rates, which could influence the energy of the area.

-

Maintenance Concerns Some of the residents have complained about issues with the upkeep in common spaces, indicating that there is a need to improve upkeep.

In the end, Lodha Supremus 2 in Thane is an outstanding commercial property offering contemporary offices with top-of-the line amenities. The strategic location and extensive amenities make it a desirable choice for businesses looking to secure an elegant address in Mumbai. Mumbai Metropolitan Region.

-

Entertainment7 years ago

Entertainment7 years agoDownload Hindi Mp3 Songs

-

Business8 years ago

Business8 years agoHow payday loans are becoming the preferred mode of choice

-

SEO & Digital Marketing8 years ago

SEO & Digital Marketing8 years agoGenerate More Views on Your Instagram Profile with Cool Graphic Designs

-

Auto7 years ago

Auto7 years agoWhat are Some Budget Friendly Bikes in India?

-

Entertainment7 years ago

Entertainment7 years agoTips and tricks for safe winching

-

Entertainment7 years ago

Entertainment7 years agoHow might Super Hero Thor going to help other Avengers in the Avenger4?

-

Entertainment7 years ago

Entertainment7 years agoAmusement and Water Parks to Visit in Delaware

-

Entertainment7 years ago

Entertainment7 years agoTop Websites To Download Bollywood Songs And Music Free Online